Roundup 5-10-2024

Contents

Ybor City/Channel District – Gasworx

South Tampa – Westshore Yacht Club

Economy/Environment/East Tampa-ish – Solar

_______________

— Amstel Flight

You may have noticed that we have been mentioning our desire for this to return every chance we get and, happily, it has happened:

It is great to get this flight back and connect to a SkyTeam European hub. (We also like the plane choice). The only alliance we are still do not connect to a major European hub for is One World (yes, we have British Airways, but that goes to Gatwick not Heathrow. We would love to get Madrid, which is a One World hub as well, with Iberia even with just an A321XLR)

And while we would like to see it be year round, but, as one airline/travel website, whose writer is from here, noted:

It definitely is something, and it is a way to develop more service. Good for the airport.

The Airport CEO search continues.

The new CEO is scheduled to assume the role in early 2025.

“He’s the best in the business,” Lopano said. “Everyone in the business knows him.”

Honestly, as we have noted before, this is a bit bizarre. The Board is going to pay someone to give the Board questions to ask the four people who work at the Airport and whom the Board presumably already knows and has seen working up close. But anyway,

Hopefully, they can make the right choice.

There was news about the possible make-up of the often discussed board of local transportation boards:

We are not sure how we feel about that.

Well, the first lesson they should learn is that Orlando officials are not a shall we say sensitive about their territory as our local officials. Another is that, if you just look at the members listed on the MetroPlan Orlando website, you notice that their transit officials appear to be voting members. Of course, they don’t need three seats for that because they share a transit system. Those wacky Orlando folks.

Honestly, we are more concerned with voting representation being weighted by population to provide at least the possibility proper representation. And even more importantly, as our history has shown numerous times, you can rearrange the chairs all you want, but nothing will change until our local politics – which created and/or sustain the persistent issues – change.

The Times ran an article on Brightline.

So, the Mayor and the former Mayor, now essentially lobbyist, met. Other than that Brightline is raising prices for their multi-ticket packages, did we learn anything?

Station locations in both Tampa and Orlando have yet to be announced.

Meeting attendees have otherwise been mum on discussion details.

Setting aside form that the rhetorical confusion of what transit is continues (and note: it already has a stop at Orlando airport and there are no plans to go to Orlando proper. The missing “Orlando” station location is probably the theme park location.), not much.

Ybor City/Channel District – Gasworx

Another building in Gasworx seems to be moving forward:

This building is along the Nuccio Parkway south of the buildings being built (those buildings are on the right side of the full Gasworx rendering) with the retail mostly on a side road, which is not optimal in our view, but may work out OK. We will have to see how the whole thing comes together with the other elements of the development.

A while ago we discussed the former golf course at USF, known as the Claw, and how USF should save the land for future use rather than develop it. There is enough land in private hands around USF for entertainment districts and what have you. Well,

That is not really extending campus. And looking at the map, it is clear the Claw is not really a gateway. It is a boxed in piece of land that is much more north-south than contacting the university and with no major access to roads except Fletcher (unless you are Tom Sawyer).

That’s all well and good, but the location is not. College towns are not made by isolated destination entertainment centers. They are made by having a town around a campus.

And using public land for an entertainment complex is questionable. And, if you look at the map, it is really not that accessible from most of campus. If the school wants a improve the campus, it should eat up some of the surface parking lots all over the main campus and redevelop them. Or maybe the “research park”. This is all especially true given the obvious competition that will come from the University Mall redevelopment and the next item.

There are two proposals for the MOSI land:

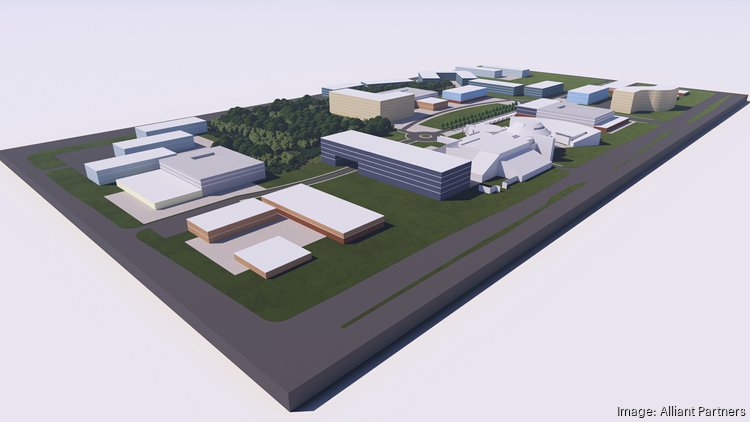

The first proposal: Alliant Partners

The second proposal: RGA team

You can see the members of each team in the Business Journal article.

There is not a lot of detail in the Business Journal article, but from the information in it, we are not really inspired by either proposal, but the RGA proposal at least has some logic and order to it (though there is a lot of surface parking, which is not so good). And the RGA proposal purports to attempt to build an actual urban development (but there is all that surface parking). Aside from the road through the building (which probably would get value engineered out), the Alliant proposal looks rather scattered and boring.

But, other than thinking neither one is very interesting, we would need far more detail to develop a stronger opinion.

South Tampa – Westshore Yacht Club

The not on the water condos of Aqua at Westshore Yacht Club are moving forward:

A three-tower condo project in the Westshore Yacht Club will celebrate its groundbreaking next week.

While the buildings are not actually on the water, we find it impressive how the architect hearkened back to the classic late 70s/early 80s Florida retirement condominium vernacular.

The Times had a Bloomberg story on rent which told us this:

And that does not include everything else people have to pay for. Keep that in mind when you hear rents inched down a bit or wages inched up a little.

As you might expect given a solid tourist industry statewide (and even nationwide) and inflation:

Tourism continues to boom in Hillsborough County. And the numbers, officials say, prove it.

That is solid. We are not sure how it compares to other tourist areas in the state and country, but it is solid.

There was an interesting article in the Times recently:

What does that mean? We are not sure. We do not know how to judge the veracity of the report, though they say they have experts in patient safety and list a bunch of people which you can see here and we are told this:

You can read it here. Do with it what you will.

Economy/Environment/East Tampa-ish – Solar

The Business Journal had an article on Citi’s installation of a lot of solar power generation at its campus.

Citigroup Inc. will power a portion of its Tampa campus with a new rooftop solar project.

We think it is a great idea. Far more big box/big roof area buildings should have solar arrays.

That was the only quote in the article from a government official, and it is fine as far as it goes. It is just kind of odd because the Citi complex is not even in the City.

As we discussed a while back, in the wake of SunRunner opening, St. Pete was looking at changing its zoning to take advantage of transit, provide more housing, and generally get more urban.

It is not that rare in places that have actually planned decently, but still it is a good step. Things like this:

While we did not analyze every detail of the plan, we are generally for allowing more density. It is good they increased it from the initial ideas. As for all the details, you can read the article here.

We will see what the City council does, and we look forward to hearing about other changes in other parts of town. Maybe, someday Tampa will actually do something.

This week’s Rays news is here, here, here, here, and here.

And there is an interesting article comparing ballpark hot dog prices here.

Roundup 5-3-2024

Contents

Downtown/Channel District – Water Street, Phase II

Governance/Politics/South County – Back to the Future

Westshore – Soon to Be Former Plaza

Meanwhile, In the Rest of the Country

_____________________________________________

Downtown/Channel District – Water Street, Phase II

The next phase of Water Street was announced, sort of.

Water Street Tampa’s second phase will look quite different from its first.

The buildings won’t go vertical before spring 2025 when infrastructure work is complete, SPP said.

As you will see below, it is still in the works. But, first, what they said:

A noted in the Times article:

That implies that the condo building will not have retail which, if true, would be unfortunate.

But let’s look more closely at each of the three buildings, starting with the office building:

Kohn Pedersen Fox completed the tower’s conceptual design, SPP said.

Moreover

In other words, the rendering provided is just a conceptual drawing of something that may or may not be built, and, if an office building is built, it may or may not be anything like the rendering. It is not a planned building in the normal sense of the word. That being said, here’s the pictures:

That building looks nice enough, but, as we said, it is just a drawing. As for who will go in it (theoretically):

That sales pitch did not work out as planned. But, as noted elsewhere in the article, is it possible that with the Water Street product a little clearer, a pitch might work better. On the other hand, there are still a number of other “hot” cities vying for all these businesses.

Moving onto the condo building, it is more a planned building in the traditional sense, but apparently fully planned:

Here are some renderings:

As noted above, the condo will be the tallest building in the district (though, of course, height is measured in units of distance, like feet or meters, not floors. Floor heights vary for a variety of reasons.)

The final proposal announced will go where the very cool proposal for an office building (400 Channelside) was supposed to go:

Moreover,

That is all marketing speak with very few details, so we cannot real speak to anything other than the idea of a cluster of “entertainment venues”, but we will see when they actually present what they want to build. Until then, we are not going to worry about it, except to stay that many cities have entertainment venues in and around other development and not in stand-alone, purpose built clusters (say Nashville, for instance. Then again, Nashville did not bulldoze almost all of its old downtown fabric and turn it into surface parking). That is kind of what being in a city is about. Not that we are against have a vibrant area with lots to do, but purpose-built entertainment clusters are tricky and often disappointing. Once again, we will have to see the details.

Going back to the map and Meridian, we are not sure why the buildings do not go up to the sidewalk/trail. The map indicates green space, but is that a lawn/park (whether activated or dead space like Pierhouse) or a retention pond (like at Towers of Channelside)? Depending on its treatment, it may make a difference. (Were the train tracks and the potential for transit removed just for a lawn or retention pond?)

All in all, the only thing we can say is that there is a proposed condo tower that is not bad looking. The rest, while seeming to keep with the basic themes of phase 1, is all very vague. Hopefully, we will get more details soon.

The Gateway Express is finally open. From last week:

AS is not secret, we do not like the variable rate express lanes (the map seems to indicate right now there is not variable rates on the express lanes, but the FDOT website says otherwise). However, the rest of the project should have been done long ago. (Much like the non-existent northern east-west road.)

We have been wondering how the downtown shuttle using Teslas that replaced the Downtowner is doing.

However,

The Tampa Downtown Partnership still sees DASH as a success.

We tend to think moving fewer people per day is not a good way to replace a transportation service. But success is performance relative to goals and we do not know the Downtown Partnership’s goals, so maybe it is a success to them.

Which brings us to this:

More interestingly for us is this:

29% of the land is used for parking. And the majority of parking spaces are in private hands.

Anyone who has looked knows there is a lot of land banking with surface parking lots going on. It seems that those spaces may not be needed. It is well past time to change how those surface lots are (not) taxed to incentivize using the land productively.

Governance/Politics/South County – Back to the Future

A couple of weeks ago we wrote about the proposed “renewal” of the CIT and we said this:

Well,

We get it. The Commissioner serves South/East County and, in the tradition of Hillsborough Commissioners, he is not going to make the developers pay for the cost of their developments. He wants the taxpayers to do it.

Actually, filling in the service area with density and good infill is smart growth. Having developers (rather than taxpayers) pay to develop outside the urban service area is smart growth. Sprawling ever farther is not smart growth, at least not if your priority is the taxpayers and efficient use of land (not to mention taking care of all those unfunded transportation needs that already exist). His plan is simply subsidizing more sprawl.

Actually roads were built (as noted here, for instance). However, there was a big failure. The area was poorly planned with the vast majority of traffic forced on a limited number of arterial roads with almost no other connecting roads (as opposed to a well-connected grid). It is basically intentionally creating bad traffic and, in typical poor Tampa Bay planning form, there are no alternatives to driving. And nothing we have seen for any development so far changes this failed limited arterial road model. Putting money into that model is simply subsidizing the more failure at the expense of the people already residing in Hillsborough County, including the majority that do not live in South County and also have quite a bad road and transportation network.

If developers want to develop outside the urban service boundary and pay to connect to their developments, fine with us. And, in fact, that’s what impact fees are for: to pay for the impact of new development. Of course, being outside the boundary makes the impact more expensive. The County should charge them for that expense and taxpayers should not be on the hook. However, the plan he presents now is nothing new. It’s the same old sprawl subsidy that got us into the transportation mess we already have. Repeating that pattern will never cure the problem.

Westshore – Soon to Be Former Plaza

The demolition of Westshore Plaza took another step forward:

“Tampa is changing. Tampa is growing,” said council chair Guido Maniscalco.

We would not say the plan is a plaza comeback (at least we hope it is not). It is a replacement.

The full project breakdown includes:

- 901,831 square feet of retail

- 380,000 square feet of professional office space

- 120,000 square feet of medical office space

- 1,765 multifamily residential units

- A 256,000-square-foot hotel or motel

- 133,119 square feet of restaurant space

- A 77,357-square-foot recreational facility

- A Hillsborough Area Regional Transit Authority transfer bus station

Like all projects of this nature at this stage, that is all subject to change. The final product might look like the rendering (though we assume it will not be quite as blurred), but there is a really good chance it won’t. Hopefully, it will not end up being a big empty lot for a long time or a bunch on one story big boxes and outparcels. Market forces would seem to be against that prospect, but you never know what might happen (especially when they are throwing around odd ideas like a hospital). We will just have to wait and see. . . probably for a while

Maybe, a long time

We do not mind waiting a bit if it brings a good, urban, walkable development. (And “good” includes providing some protection from the elements like awnings so people actually want to walk around. There don’t seem to be any in the rendering, but admittedly it may be too blurry to tell.)

There are some more renderings of the proposals for Lot 5 and Lot 12.

For reference:

Here is Lot 5

From Vilatic at SkyscraperCity – click on picture for post

The part facing Nebraska (east view) is not bad. However, the west view is quite poor. Sadly, is seems to be yet another building with poor-to-no garage screening (it is so common it almost seems as if it were a city regulation). Street interaction is nonexistent. And, if that were not enough:

Here is Lot 12

The southwest view gives you the same dead street frontage as the Lot 5 proposal. There may be some garage screening, but it does not seem to be enough to even cover up the garage in the rendering. There is no street interaction. Moreover, depending on the use of the lawn, the Nebraska frontage may also have pretty much no street interaction except at the corners. The purpose of the lawn is not clear in the drawings.

It seems that the developer is planning on Blanche Armwood, the street just west of Nebraska, being quite dead. Unfortunately, having a long, relatively narrow, mostly dead street is not a really good way to build a solid walking neighborhood.

We have said, and we maintain, that these proposed buildings are better than the first phase of Encore! (which had some very unambitious designs). At least the new buildings have real density. However, that does not mean that they could not be better.

And, because unfortunately we cannot build underground, the City really needs to address screening garages. It is one thing to be a “pro-development” government. It is another to not have any standards.

Meanwhile, a few blocks away:

We are glad this is moving forward. A bit more alacrity in getting the work done would be nice, though.

We now have a time for the recently initially approved YMCA redevelopment to break ground:

Hopefully this will actually be the date. We shall see.

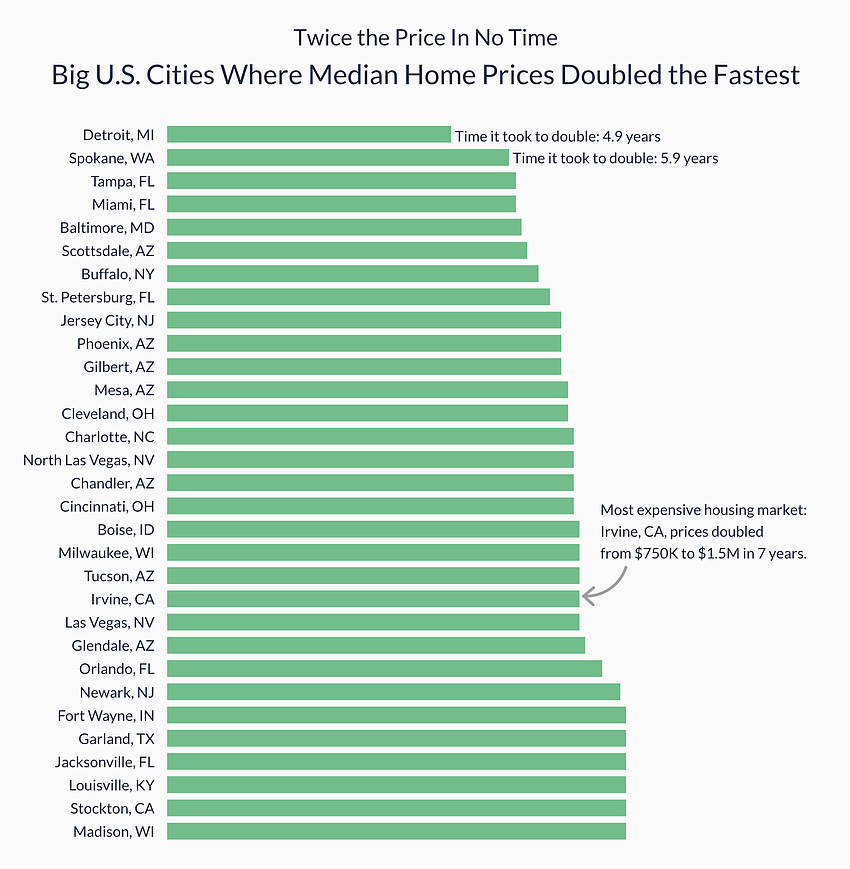

We all know local home prices have shot up, but just how fast?

In Jacksonville, Orlando and St. Petersburg, prices have doubled within six to eight years.

In Jacksonville, Orlando and St. Petersburg, prices have doubled within six to eight years.

We admit there are some rather surprising locations where prices have shot up, but, for our purposes, that is irrelevant. What matters is how it has become far harder to buy a house here.

The Report is here.

This week’s Rays news is here, here, and here.

In further news, the Rays released their City Connect alternative uniforms which were kind of interesting because, first, unlike the regular Rays uniforms, they actually say Tampa Bay. Second, there is a kind of cool alternative Ray logo with the Skyway in it. Third,

Plus

What is so cool about that, not only does it honor skateboarding, but even more importantly it continues the Tampa tradition of unnecessarily demolishing something then honoring it (One of the biggest examples being the old County Courthouse which was demolished long ago then ended up on the Hillsborough seal before the awful new one honoring a band shell was inexplicably adopted). In this case, the Bro Bowl was unnecessarily demoed as part of redoing a park (that has since been treated questionably).

Meanwhile, In the Rest of the Country

While Brightline expansion is in a bit of a holding pattern in Florida,

We have no idea when the Florida line might get to Tampa. Maybe never.

You can read more here.

As we noted last week, Oracle is moving its headquarters from Austin to Nashville. This is the reasoning given:

Not surprisingly, Nashville is a getting a lot of “hot city” articles, like this one from the Wall Street Journal.

Aside from Oracle announcing it was moving to Nashville and a few of other things, not that much happened in the last week, so we decided to take the week off. Enjoy your weekend.

Roundup 4-19-2024

Contents

– A Little Civics Lesson Every Now and Then is a Good Thing, Cont

Channel District/Ybor-ish/Port – Ybor Harbor

Hospitals/South Tampa/West Tampa – Money and Stuff

______________________________

The County Commission moved to renew the CIT, sort of.

We will get back to that last point shortly. But first,

And there was this:

They also limited the school money.

So, what is the plan for the money? It is not clear, but we would not be surprised if it is mostly roads in South County.

As we keep saying, the Commission should just have renewed the CIT. But we did not think they would. This is a different program with different people deciding how to spend it, and it should be thought of differently. We are still undecided. But, as we said previously, there is time to think about it.

– A Little Civics Lesson Every Now and Then is a Good Thing, Cont

Now, back to that comment. This is the actual X post:

While we are not for most blanket statements, one is certainly entitled to think that every tax should expire after no more than ten years and/or that the CIT time frame was too long. However, that is just an individual policy position. It has nothing to do with the concept of consent to taxation in the Declaration of Independence.

As we noted previously (here), the Founders’ concern with consent to taxation dealt with their experience of having taxes imposed on them by the British Parliament to which the colonies could not send voting members (thus the colonies had no say). Under our representative form of government, contingent on their authorizing law, representative bodies (like the County Commission, which is considered a representative body, no matter how imperfect it may be) can levy various types of taxes. Moreover, there is no tax time limit or referendum requirement in the Declaration of Independence or really any writings of the Founders regarding taxes. In fact, the Founders were not fixated on governance by direct democracy. For instance, they did not think Senators should be directly elected by the people (we know that because Article I, Section 3 of the Constitution tells us so). And, in point of fact, the Founders were fine with Congress (a representative body) raising taxes (without time restrictions). It says so right in the first line of Article I, Section 8 of the Constitution (and see also Whiskey Rebellion).

As for Dixiecrats, we are not sure what a short-lived 1948 political party had to do with the CIT, which was passed in 1996. Moreover, the person who came up with the CIT plan was not a Dixiecrat, or even Democrat. And we are not sure about having an open vote about a clearly defined and much-talked about tax with a clearly defined term after previously unsuccessful referendums is “sneaky”.

Nevertheless, as we noted above, everyone is entitled to their own opinion on how long they would like a tax to be in force.

Channel District/Ybor-ish/Port – Ybor Harbor

The Ybor Harbor project proposal for the north end of the Ybor Channel got initial approval:

Previous reports said this project would not start until Gas Worx was finished, so it may take quite a while. The renderings are probably mostly conceptual, and it looks like a nice concept. As with most things, though, the details will matter. We just do not have them yet.

More broadly, there are questions by some about the viability of the port. Previously the developer has said he would work with port facilities in the subject area to find new locations and according to the article said this:

That could all be talk or he could mean it. It is certainly possible to have a development like this and still have a major port nearby. It will take some work to do it right, but there is time to work on it.

A few weeks ago, we discussed home insurance (here). We noted some of the reasons given for why it was very expensive but that people were promoting investing in the insurance business for the quite healthy returns. Given that, a recent article in the Times is not really a surprise:

We are not going to get into the whole report because we have no way of knowing if it is entirely accurate but you can find it here.

Anecdotally, we (as probably everyone else has) have heard many stories about a number of the small and/or start-up insurance companies, how people who were pushed to them by Citizens then got dumped again after paying premiums for a few years, about companies going bust right after storms while the management getting paid, and so on.

Given that the entire real estate industry (and therefore arguably the whole economy of this state, see below) relies on having a properly working property insurance system, that should be the goal. What we need is a solid plan to deal with insurance that focuses on 1) actually covering people and 2) keeping costs relatively sane. We really do not care if it is run as a market of private companies or a cooperative program of home owners (something along these lines does seem to make some sense). We care that it works.

You can read the article here.

As the Tampa Bay Partnership Regional Competitiveness Report makes clear year after year, we lag other comparable areas in economic productivity. So, what exactly do people do here?

Florida has long been a real estate/tourism economy. Now you can add some finance, though in this area our financial services jobs are often more back office jobs not the big money part of finance. However, yes, there are a few of the bigger money jobs around (say, the large company in the Gateway area).

There is nothing wrong with real estate. Thriving economies need real estate development. But real estate is not as good as an end in itself. With real estate, there are always the questions of 1) what kind of development is it? and 2) is the economy supporting real estate or real estate supporting the economy? Ideally, the area would be a net exporter of ideas and goods. We would sell those ideas and goods, bring in money and expansion, and that would drive the real estate sector. As of yet, we are not one of those places.

More broadly, if you look at the Tampa bay Partnership Regional Competitiveness Report (have we mentioned how much we appreciate these reports?), we have been pretty much last or very close to last in per capita GDP for quite a while, so maybe the mix we have is not the best.

We are not completely sure what this really means but:

And the Tampa Bay area number is way higher than everywhere else:

It could be that our percentage of millennials was oddly low, so a decent number moving in gives a higher ratio. Or the number could be exactly what it seems. Or something else. Regardless, people want to move here. Too bad we do not have the necessary infrastructure for an area with the population we are getting nor do many of our officials seem capable or even willing to get it.

If you think traffic is bad now . . .

Inflation news is mixed.

Keep in mind, that is the rate of inflation, not prices, coming down then going up again. But even with slower inflation, there is already damage done and prices are still increasing on top of that, as noted in this quote from an article in The Atlantic:

That is just food and nationwide. Then note this area’s inflation has quite consistently exceeded the national average in the last few years and our housing and other costs have shot up.

There now is a USF stadium timeline:

That centers on USF’s Oct. 19 home game against Alabama Birmingham at Raymond James Stadium.

And there are some new renderings:

And some more information in a Times article here.

It would be nice if this all leads to a Power-[ed: does anyone even know at this point?] conference. (Maybe the Bulls can replace FSU in the ACC).

Hospitals/South Tampa/West Tampa – Money and Stuff

There was a variety of hospital. First, TGH broke ground on a new facility at its island home:

The family’s generosity should be applauded.

As for the building, it looks fine, but we still wonder if building major facilities on a low lying fill island instead of on the big chunk of land on Kennedy that TGH bought is the optimal policy. We get that what is on the island is on the island and we know why the hospital was originally put there, but does it really make sense to add such a major building to the island campus when there are other options? We have to admit that we are a bit skeptical of relying on the plastic sheets to keep the level one trauma center accessible in the event of a big storm (or sea level rise), especially since they do not protect the bridges. And note that the land on Kennedy is still in the “medical district.”

Then there was this:

Tampa General Hospital will create a new men’s health center with a recent $6.5 million donation.

This sounds good, but we are not sure why this location is unclear. If the main campus is good for the big thing, it should be good for everything.

Meanwhile, local hospital generosity does not stop there:

That is incredibly generous as well.

Hopefully, the City will not mess up Habana too much in its redesign and make St. Joes and all the offices around it much less accessible. (Looking at its preliminary plans – here – it is not clear that anyone in the transportation department has regularly driven/used this stretch of road and really looked at the traffic, pedestrian, and bike behavior. But that is for another discussion.)

This week’s Rays news is here, here, here, here, and here.

The Pasco County Commission does all manners of odd things, but even they seem to know that if you want something, you have to pay for it. For instance:

Not to mention

We do not have an opinion about the specifics of the tax or whether there is other money in the budget that could be used. But at least they, unlike some other local officials, seem to understand the basic idea.

You can read more here.

Roundup 4-12-2024

Contents

Meanwhile, In the Rest of the State

_______________

The Times had an interesting opinion piece on traffic.

Some things aren’t the way they seem. They don’t make sense, at least at first.

It then goes through some statistics that you can review here. Then there is an explanation of why there might be more traffic:

While the study cited is a bit old, the reasoning makes sense (and maybe it is being proven right now). Moreover, there are more people living here. There are more visitors. And in a place where you have to drive everywhere for everything and the government makes a great effort to push everyone onto the same limited number of arterial roads, those more trips will manifest themselves in more traffic and congestion.

Interestingly, one of the claims about variable rate express lanes was that they would help reduce congestion by making people not drive at rush hour all the time to avoid traffic and charges. It was posited that they would choose to go to work at different times. If the research in this article holds true, it seems that may not really be exactly accurate.

The streetcar keeps going along:

Not that per trip cost is the be all and end all measurement, but the generally study by the generally anti-transit Cato Institute provided these figures of the Tampa streetcar and the national average for streetcars.

| System | Location | Passenger trips | Fare revenue | Operating expenses | Fare revenue per trip | Operating expenses per trip | Tax subsidy per trip | Farebox recovery ratio |

| TECO Line Streetcar | Tampa, FL | 1,107,584 | $0 | $2,780,595 | $0.00 | $2.51 | $2.51 | 0.00% |

| Totals / Averages | 29,775,767 | $28,930,835 | $321,481,876 | $0.97 | $10.80 | $9.83 | 9.00% |

By that metric, the Tampa streetcar is not too bad at all. Moreover, aside from per ride cost, it allows more efficient use of parking around the core which is good for the city and the City.

It is a solid program, and it should be funded and expanded, especially with the planned development in Tampa Heights.

It seems the state will not help with Brightline’ expansion.

We are not sure what tangential infrastructure is exactly. And, while the one high speed rail program is problematic, it should be noted that California has a wide variety of commuter and intercity trains as well as light rail and subway systems, and there is Brightline project from LA to Las Vegas that got Federal funding.

Also, the State of Florida has already bought a large amount of track around Orlando for SunRail. And there is Tri-Rail, which also runs on rails bought by the State.

But back to Brightline (Florida):

We understand going project by project to decide whether it is worthy of funding based on the specific plan and it merits (and maybe the super expensive route is not really the best). But we generally do not favor blanket statements. And, while it is not clear that it is the policy, it would seem to be unwise to forgo Federal funding while our money goes elsewhere, but it would not be the first time Florida does such a thing.

First, let’s check in with the Airport CEO search.

But then again:

This all seems oddly disorganized, especially for a group that presumably has been interacting with the airport leadership on a regular basis and, therefore, should be very well acquainted with the internal candidates. Hopefully, the board can get it squared away.

Meanwhile, the airport released the performance information for last year, which was a record year, with a factsheet covering the calendar year (here) and an online report covering the fiscal year (here).

Meanwhile, over at St. Pete -Clearwater:

While we do not know the exact plan for the garage and therefore cannot comment about it, we have travelled through St Pete-Clearwater at peak times, and it seems quite clear that the terminal needs an upgrade to deal with its increasing passenger traffic. Good for them for getting the financing all worked out.

After a step back on the stadium, USF is now moving forward:

We do not have an opinion on the specific companies, but if they want to get it done by 2027, they need to get moving, so in that respect this is positive. We will see what the results are.

Meanwhile, the Business Journal article posits this:

(Oracle article here)

USF does not need to do anything of the sort. The University does not seem to be paying taxes on the land. It does not need to be a retail developer. It does not need to sell to developers. It is not required to make anyone else a profit. It could, like many universities do, hold the land indefinitely for some future use that may not even be apparent yet. In fact, that is what it should do. There is ample privately held underused and developable land that private developers can redevelop all around (but not on) the campus (not to mention MOSI). No need to waste public land on it (and then have to use tax money to buy land at a much higher price when the school needs it later).

We are fine with having a main street. Make it part of the MOSI or University Mall redevelopment. Or tear down a few local strip malls and build one.

We saw some news about the Ybor CRA in La Gaceta, so we looked for the official word and found it on the CRA Facebook page:

We could understand a temporary move, but there is no indication this is temporary and it is a bit odd given the CRA slogan in the picture above. It seems to us that actually being in the community should be the bare minimum for strengthening that community.

The Pasco County Commission is has often complained about land being eaten up by apartments and not being available for other more business-like uses. Well, if land is the issue, what should be worse than eating up land for higher density apartment complexes? How about eating up land for lower density rental housing? The land is not used for those business purposes, and it does not even house a lot of people or generate household wealth and equity for the residents.

A built-to-rent development of more than 300 homes is under construction in Pasco County.

315 homes on 36 acres. (For reference, Water Street is 56 acres and many more residences, plus retail, office and hotel.) Sprawl is sprawl. And, as noted, rental sprawl is sprawl that does not help build residents’ equity and household wealth. It also does not maximize the efficiency of the infrastructure like density. But we could find no controversy about this development.

Maybe, it is not the apartments that are the issue. It is the planning.

Speaking of planning, as we note often Pasco County is the poster child for sprawl (though it really seems that they learned everything they know from Hillsborough County which made all the mistakes first). The Pasco County Commission has routinely ignored past commitments to preserve rural areas and other manners of other planning. But recently there was this:

First, that last comment could be said for all the counties of this area. That is the result of decades of having low standards and then settling.

On the one hand, we are happy they are not just rubber stamping development proposals. Unfortunately, we are not sure exactly what is going on with this project. (The article is a bit vague on details.) We are fine with not bending on the amount of parkland. But is the planning commissioner looking for more structured, more street parking or more big, ugly, hot surface parking lots (which, it should be noted, usually look like the aforementioned crap). Moreover, is it really up to the planning commission to try to figure out where apartment dwellers want to park? We know many people who prefer a garage but we are sure there are various apartments with surface parking as options for those who seek it in Pasco.

We applaud not approving projects until commissions know what they are approving and we support generally sticking to plans with the caveat that we also think the plans should make sense. And, as indicated above, we are not exactly sure what the planning commissioner is pushing for. Hopefully, he is seeking good things. In any event, we hope Pasco starts to actually raise its game, develop good plans, and stick to them.

You can read more here.

This week’s rays news is here, here, and here.

Meanwhile, In the Rest of the State

Meanwhile, over in Orlando where counties and parties can seem to work together to promote the area:

There is more but you can read it here.

Setting aside the related sprawl, we applaud the effort to be forward thinking in design.

Roundup 4-5-2024

Contents

Governance/Politics/Schools – Tax Referendapalooza

USF Area/North Tampa – 4151 E Fowler Ave

East Tampa/Governance – Parks and Rhetoric

______________________________________

Governance/Politics/Schools – Tax Referendapalooza

It seems, among all the other referendums we will have this year, there will be a school property tax referendum and a weirdly mutated CIT referendum.

Schools, which have long been receiving 25% of the tax revenues, now stand to get 5%.

As far as we can tell, the fifteen year duration serves no real purpose other than making it much more likely that this CIT will not be able to fund any truly substantial project. As for the schools getting CIT money and their own referendum:

Five percent is expected to give schools about $187 million for the life of the renewed tax.

Do not forget they have schools that are far below capacity and that could have been closed, but that is a discussion for another day.

In any event, we are not going to decide our position right now about either of these proposals, though we do have some serious questions about both.

As a general principle, we are not against taxing ourselves for things we need, but, when we do that, we want to give it to people with a sound plan and the discipline to execute it properly and not waste the money on other things.

There is still time to weight the issues.

Tampa has new e-bike and e-scooter rules.

Now, the city of Tampa wants to crack down on haphazardly discarded e-scooters and e-bikes.

The city has also set up an interactive website where residents can request new corral locations.

We are fine with these steps. We are fine with the machines. They have a place in larger transportation system (though that place is often exaggerated by various parties of various reasons) Nevertheless, while most users are fine, there are some that are sometimes a problem (and not just where they dump the machine).

And we are not so happy about them on sidewalks. Quite interestingly:

Which seems to us to be a tacit admission that there are issues with them on sidewalks. Unfortunately, our bike infrastructure is still not really developed.

Additionally, it is a bit odd that the machines will be allowed all over the City when there is no real infrastructure in most places, but that can change.

Finally, to return to a theme: there is also the problem of connections between the City and the County since, as we keep saying, there are parts of the County much closer to the urban core than the parts of the City. It is a failure of local government to not coordinate this and other transportation infrastructure (including bike lanes and trails).

A few weeks ago, we noted that PSTA was going to have a public hearing in St. Pete Beach about a project in south St. Pete. We are not going to get into all the coverage (you can read it here and here), but we did want to note this:

Connectivity is important, and if the State Representative is really interested in having a transit system that works well, great. However, it is rather obvious that if one starves the system of money and subvert the parts that work well, one will not get a decent product. (As for micromobility, that would be great getting from a station/stop on a larger network to the actual destination – a/k/a the legendary “last mile” – but not really for getting from Eckerd College to most useful places. But, like the imminent rise of autonomous vehicles and car sharing 10 years ago, micromobility is often raised just as another excuse for not having a real transit system.)

And we look forward to the transportation town hall in south St. Pete.

We have done a decent amount of nighttime intercity interstate driving recently and it is obvious from things like full rest area parking lots and trucks parked along the side of the road nearby that this is sorely needed:

Plant City Mayor Nathan Kilton said the upgrades will be helpful.

While the article does not seem to specify the exact location, a map with the article shows County Line Road between Lakeland and Plant City. That is a fine location, though far more spaces are needed. There is also a need on I-75.

That is also a good idea.

There are happenings with the WestShore Plaza redevelopment project:

Let’s hope it is not sprawling instead of being well designed, walkable, and urban.

The full project breakdown includes:

- 901,831 square feet of retail

- 380,000 square feet of professional office space

- 120,000 square feet of medical office space

- 1,765 multifamily residential units

- A 256,000-square-foot hotel or motel

- 133,119 square feet of restaurant space

- A 77,357-square-foot recreational facility

- A Hillsborough Area Regional Transit Authority (HART) transfer station

We do not mind rebuilding the whole lot, depending on what goes there. We do not understand the hospital thing. Is there any demand or plan to put a hospital on that lot?

You can see some renderings at the Accela entry for 100 N West Shore Blvd here and at SkyscraperCity here. But, in truth, it seems like the plans are completely in flux at the moment, so we are not going to bother getting into detail about what has been filed so far. Hopefully, they come up with something good.

There was some preliminary movement on the YMCA redevelopment project:

- A 70,000-square-foot YMCA with a skybridge over Florida Avenue

- A 200-room hotel

- 100,000 square feet of retail including space for minority-owned businesses

- 184,000 square feet of office space

- A residential building with more than 400 units of multifamily housing. Ten percent of units will be designated as affordable

- 1,444 parking spaces

We are fine with that. The project could be a little better, but, from what we have seen so far, it is pretty good and will really help get that part of town going (as long as what remains of the historic fabric survives and is repurposed).

We will see if this really gets done.

Britton Plaza (well, most of it) seems to for sale.

Whether it is “generational” or not depends on what gets built, and, in addition to the developer, that depends to a large degree on the City Council and the surrounding neighborhood.

Meanwhile, there is speculation:

(Wild 94.1 article here) And, while it is a good piece of land, we are not so sure about this:

Maybe, but probably not. It is not nearly as accessible or central to the area. Nevertheless, it would be nice if it was developed into a good, walkable, urban, mixed use area, but we shall see.

USF Area/North Tampa – 4151 E Fowler Ave

There is a proposal for a project just south of USF (Accela entry for 4151 E Fowler Ave here).

It appears the plan is to replace three one story office buildings (here) with three nine story apartment buildings totaling 582 units (from Accela though some say it is more) with 12000 sq ft of retail and a bunch of parking.

We do not really have much on this version of the project. In the Accela file are renderings of a seven story version of the project that have some of the blandest buildings known to man (not this kind of stuff, we mean really bland). Hopefully, the newer version is not that bad because having density (as long as it is decently designed) along Fowler would be a good thing.

East Tampa/Governance – Parks and Rhetoric

There was an odd Times editorial regarding the redevelopment of Fair Oaks Community Center/Park.

Tampa taxpayers, you’re about to make history — your first $100 million park.

Rather than copy the whole editorial, we will just go to the setup for the odd part. First, the park started out as a $200,000 idea, then kept growing until:

Certainly, wildly escalating costs (like the Hanna facility) should be reviewed. But this is where things get odd:

That is, shall we say, an imperfect comparison. Where are the 30 year costs for Riverfront Park? Where are the 30 year operating costs? Why is there no estimate of those included in the math? Where is adjustment for inflation (there has been quite a bit since Julian Lane Riverfront Park’s reconstruction, approved in 2016)?

Moreover, the City used basically the BP oil spill money and CIT money on the park so the debt is low, but then there is all the debt service for things that money was not spent on, like East Tampa parks, stormwater projects, roads, streetcar, etc. And by doing that, the city increased the costs of those things. Oddly, that is how money works. If you use it for a bauble here, you cannot use it for a need there.

If the Times wants to question the cost of the park and project mission creep, that is fine. In fact, it is good. We are open to hearing real arguments of why the Times thinks the project lacks merit. We are open to an examination of the escalating costs and whether there is a problem in the process.

Unfortunately, the editorial does not really do those things.

Auto and homeowners insurance costs are going to be a major drag on Florida if things stay like this:

There are various reasons put forward for the costs:

To some degree that is probably true, but why are we so out of whack with Texas and Louisiana then?

Later in the week, we saw this:

And this. Maybe the state on a good course (for someone), but we do not consider paying premiums almost twice as high as the next highest state to really be having the issue fixed. (And we think it likely that most people are more concerned with the cost of insurance and getting claims paid rather than how much insurance is a private market and how much is something like Citizens.)

Moreover, when our rates are that high and some are pitching 165% five year returns on investment in the supposedly very stressed insurance market, it kind of just makes you wonder about the whole thing.

The city of Tampa has put out an online “Economic Dashboard” https://www.tampa.gov/economic-dashboard It has a number of stats that may be of interest, though some are a bit selective. For instance, it has central business district office occupancy but not Westshore, which has more office space or the city overall. But it is still worth a look.

There was an interesting move at USF:

We are all for this. It is an excellent idea regardless of whether it is the first in the state or not.

This week’s Rays news is here, here, here, and here.

There was an article in the Times regarding cigar factories

Since 2009, J.C. Newman Cigar Co. has been Tampa’s last operational cigar factory.

They now run the last operational cigar factory in the nation.

You can read more here.

Roundup 3-29-2024

A number of things came up this week and a number of things are going on this weekend, so, rather than try to do a whole Roundup, we decided to go with a picture (since it is worth a 1000 words, and all that).

The picture, taken in January, is of a newly constructed sidewalk at the plaza in Carrollwood where there is a Foxtail Coffee. The pole in the middle of the sidewalk is actually a replacement for a previous pole in the same location.

When you hear about infrastructure improvements and all the good things they can bring, remember that, without citizen involvement, it can also bring this.

Enjoy your walk.

Roundup 3-22-2024

Contents

Downtown/Channel District/Port – Not Yet

Meanwhile, In the Rest of the State

Meanwhile, In the Rest of the Country

___________________________

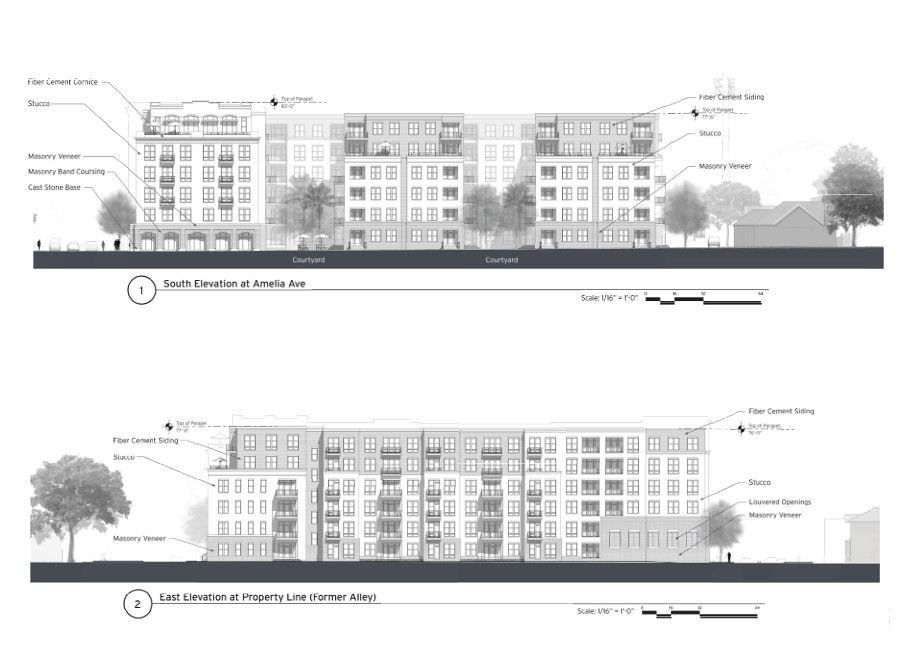

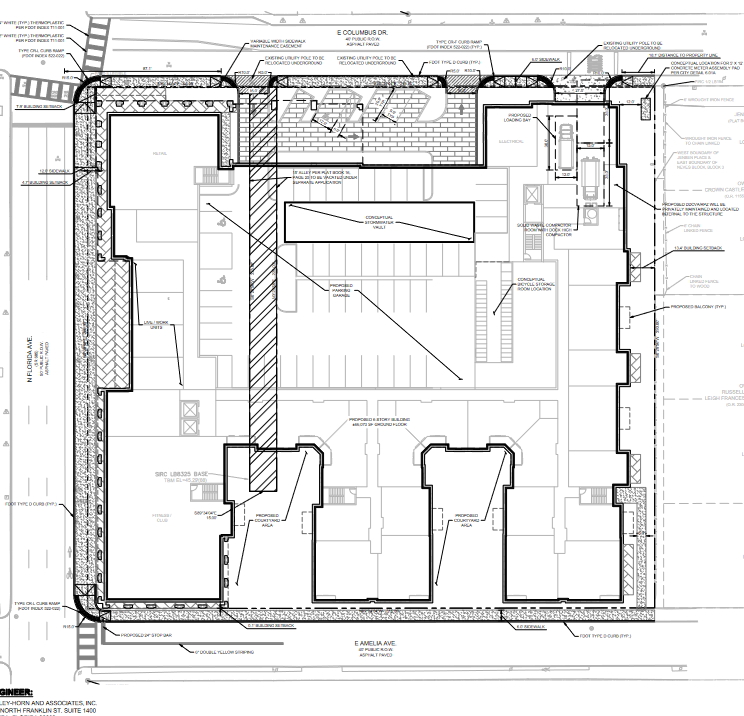

There is a new proposal for an apartment building on Florida in the Tampa Heights area. Accela for 2315 N Florida here.

Here are some renderings:

Looking quickly, this looks like a generic, new apartment building design. However, (and we had to check a few times that we were not misreading it) the Columbus façade is basically a parking garage and loading dock while the Amelia façade is completely done up. That is absurd. Why should a main road like Columbus get the bad façade instead of a small side road with basically nothing on it? It does not help Tampa Heights (or the city as a whole) to fill its major intersections and avenues with loading docks and parking garages. That is just a really poor effort, and it is completely unnecessary. It is just lazy design and should be changed.

It says a lot about the Tampa’s (lack of) standards that a developer in a historic district would even propose that design.

Years ago we discussed plans being developed to redevelop the Robles Park housing (from 2020 here and here). Now, there is something on Accela (3814 N Central Ave here). It features:

You might note a few things. First, there is a building that seems to be 150 feet. It is the closest one to Florida. It is farthest from single family homes, but we would expect tit to draw some complaints (even though they are really not warranted). Most of the other buildings are 7-8 stories. (Interestingly, the Live Local law is attached to one of the documents justifying the project.) None of those building heights should be an issue in this location. If it is, the City is not really serious about housing.

There is also a decent amount of retail. However, oddly, the largest block of retail in the tallest building runs up the side of the building (it looks like behind whatever is fronting Florida) not on the street. Even if that is a grocery store it seems odd. Of course, we would have to see a more detailed design to see why that might be and if it actually makes sense, but it is something to note.

Also of note is that the Zion Cemetery is included and apparently protected, which is a good step.

Overall, it looks relatively good. Details matter, but it is a good start.

USF is moving closer to the stadium.

In total, the university expects to spend about $15.2 million on the new fields.

And that sounds fine, but then there was this:

Unfortunately, the article does not make clear where will all those facilities go then? If there is a plan to move them again, why could they not just be moved there now so that the $15 million is not wasted? There might be a solid reason for this plan. We admit we do not know the logic, but that part sounds odd.

Downtown/Channel District/Port – Not Yet

The parking lot next to Sparkman Wharf is not going to be developed quite yet:

So, it is about needing surface parking downtown. Well, this makes it less likely that something will get down there soon:

Just do not expect anything on that lot anytime soon.

A few weeks ago, we mentioned a Hillsborough TPO survey and noted that it was more leading than most surveys we have seen. Last week, the Business Journal had an article essentially promoting the survey but included an example of what we mean:

Let’s be clear: one sales surtax passed but was poorly drafted and found to be invalid because of it. The second surtax referendum lost. What if that is the option we are OK with, like, going on the previous votes, somewhere between 45-55 percent of the County? Why is that option not in the survey?

Second,

“Improving transit” is not very specific (people who starve transit can claim to be improving it). The survey has quite bare bones transit options. And we are not sure what the “reduce traffic jam” options are. Do they include getting cars off the road by giving broad-based alternatives? Does it include getting away from the “dump all traffic on arterial roads and never build a grid” strategy?

We get that writing a survey is difficult and that trying to have a good plan in this area is, well . . let’s just say . . . difficult, but we were (and still are) surprised at how leading this one was compared to others we have seen. It feels much more like an attempt to validate preconceived ideas than an attempt to find out what people really want. They can do much better (we know they can, because they have in the past).

All that being said, you should still take it, but comment extensively if they do not give you the solutions you want.

A couple of weeks ago, we discussed the latest delay in the Gateway Express project (here). The focus of our discussion was not really about the project, but there is more news.

We are assuming they mean spring this year. It is getting towards the end of March and when we were driving around it a few weeks ago, it seemed like there was work to do, so we are not sure about everything opening this month, but you never know.

We will still welcome the new connections when they open.

Speaking of leading, while the bill to restructure PSTA did not succeed this year, there is this:

So, the project is not in St. Pete Beach at all and St. Pete Beach gives no money to PSTA, but the public meeting for the PSTA project is in St. Pete Beach. At this point, can anyone really be surprised?

On the other hand, the move inadvertently shows why having transit in dedicated lanes is a good idea:

50 minute bus ride for six miles? Given the neglect of/opposition to transit by various officials, it is not unexpected.

There are other issues raised in the article (here) and maybe those will cause it to not happen. However, the broader interest to us is about extent people will to work to keep this area from having decent transit.

Last week, we discussed the County Commission cutting the Election Supervisor budget. (here) Then the Election Supervisor wrote an opinion piece.

And then he does explain. It is all very straightforward and rational. And properly funding the Election office is a way to promote election security.

Some Commissioners are relatively new at their jobs and may have not fully understood the situation. (Others should have known.) However, it should not be clear that there really is no good reason for the Commission’s actions, and it should be reversed.

This happened a few weeks ago, but we are just getting to it.

To Hagen, such a subsidy is vital amid a regional housing crisis.

“It’s so de minimis in our contribution to this,” argued Commissioner Pat Kemp.

“It’s always de minimis when it’s with other people’s money,” Commissioner Joshua Wostal shot back.

As noted, this program has been around for years. It has a good, targeted purpose and is used by organizations like Habitat for Humanity, which is not really padding the pockets of developers.

But, OK. The Commissioners say they do not think there should be subsidies for development. As long as that really applies across the board and they do not try to sneak anything to for profit developers like subsidizing infrastructure, paying for things upfront that will be repaid later after inflation takes a cut for the value of money or giving any other fee breaks to developers in any way, then fine. At least then they will be internally consistent.

We doubt that will happen, but time will tell.

We don’t often get into issues like this, but sometimes you just have to wonder what is going on.

Recently, the Times ran a couple of articles about one of the Fearless Four Tampa Police officers who it seems everyone agrees got screwed out of part of his pension (here and here):

The articles have a picture of him with the past two mayors. And there is this:

In 2022, Lewis met with her and then-police Chief Mary O’Connor.

Last May, Lewis stood before the nine-member pension board, asking to be reconsidered.

This all seems odd to us. We do not know all the facts, but if everyone thinks he deserves more and was wronged by the police chief at the time (and that is how the articles make it seem), there should have been/be some mechanism to get him what he deserves. We do not have the exact plan, but it seems unlikely that there is nothing that can be done, whether it comes from the pension fund or the City itself.

This happened in the early 80’s. Maybe the rules (and politics) at the time were different, but there have been Police contract negotiations since then. Did pensions never come up? Could nothing have been done then? There have been many City budgets. There have been many mayors and many city councils. Could they have not made him whole?

The bottom line is this: if. As the articles seem to indicate, everyone agrees that he was wronged by the City (if there is more to the story, let’s hear it), the City officials have had almost 40 years to figure out how to fix it. You can decide the fact that they haven’t says.

St. Pete’s new tallest building is half-way done.

It is a cool building and will be a nice addition to St. Pete. We are happy downtown St. Pete is growing like it is.

This week’s Rays news is here.

Meanwhile, In the Rest of the State

The Financial Times had an interesting article on Miami:

That is pretty ambitious. We do not know if they will succeed, but they might.

You can read more here.

We recently ran this from Jacksonville and it kind of reminded us of this Frontline about Tampa.

You can read more here.

Meanwhile, In the Rest of the Country

WalletHub came out with a list of “Most Overweight and Obese Cities in the U.S.” We cannot vouch for its accuracy, but it is interesting. The least overweight is Seattle, followed by Honolulu, Boston, Denver San Jose. For instance, we are 76th (the lower the number the more overweight) out of 100, Ahead (lower number) of us are some surprises like LA (74), Austin (66), and Raleigh (58).

For whatever it’s worth, you can read it here.

Roundup 3-15-2024

Given it is Spring Break, we have an abbreviated Roundup this week.

Contents

Governance/Politics — Elections

_______________

It is always hard to get decent transit in the US, harder still in Florida, and it could get even harder:

And the vote was not on party lines:

House 95 Yeas – 11 Nays (House has an 84-36 Republican to Democrat split)

Senate 38 Yeas – 2 Nays (Senate has a 28-12 split)

In any event:

There really is not reason for the law. If the State or Legislature does not want to give money to a certain project, it doesn’t have to. It does not need a specific law. But, at this point, we are used to such laws.

FDOT is beginning its latest not-really-fix of Malfunction Junction.

Changes to the busy interchange include:

- Providing a two-lane exit and constructing a new exit ramp bridge (to the inside of the interchange) from southbound I-275 to eastbound I-4

- Changing the eastbound exit ramp from I-4 into Ybor City/East Tampa by relocating access to 14th/15th Streets instead of 21st/ 22nd Streets

- Widening the existing single-lane ramp from westbound I-4 to northbound I-275 to two lanes

- Widening the existing two-lane ramp from westbound I-4 to southbound I-275 to three lanes

The project is expected to be complete in 2027. Expect nighttime closures between 11 p.m. and 5 a.m.

While we do not mind the two lane ramp idea, we doubt it will really work smoothly in the end (especially if you are trying to get to or come from the Connector). And, as with other interstate fixes that exist without real transportation alternatives, we cannot say we think this project will really achieve that much in the long run. The already overburdened roads will not keep up with the increased load put on them.

We need other options.

An attempt to secure some money to move the Brightline Orlando to Tampa segment just a little bit forward did not succeed.

A Brightline spokesperson didn’t respond to a request for comment.

(For those keeping score at home, those road numbers come out to over $171 million/mile for a few lanes that are designed to not encourage people to use them to full capacity. And, presumably that does not include any right of way costs)

Regardless of the outcome, the Brightline prep appropriation was a good idea (and those who proposed it should be commended for trying).

It seems that the changes to PSTA will not happen after all:

We are glad it went nowhere. The legislation had little to no merit, though we doubt we have seen the last of it.

There had been some news that rents had gone down a tad from the highs. Well,

We are not sure what “Northwest Tampa” in the article refers to exactly, though, looking at the linked data at rent.com, it seems to mean NW Hillsborough County (like Carrollwood, Westchase, Citrus Park, etc.).

In any event, as we have said many times, the best way to help keep prices under control is to increase housing supply. Neither the City not the County have really addressed density or come to grips with the fact that if you want to keep increasing population you actually have to account for the new people. You can build housing by sprawling, creating a transportation nightmare, making infrastructure maintenance ridiculously expensive, and destroying anything you liked about your natural environment (which is Hillsborough’s historical pattern) and running out of land artificially quickly or you can increase density and have transportation alternatives and preserve some open space and land for the future. That does not mean you get rid of any suburban development, but you do not subsidize and favor sprawl and you allow for more density and more traditional development.

Meanwhile,

But

3.3 % is not bad at all, but we are curious about why there is a difference between areas and if it will continue.

Meanwhile,

The Business Journal links to a report here. And if you dig further through the ADP website, you find more detail on pay here. It indicates that the in February national median annual pay for job stayers was $58,900 (5.1% growth). There is quite the gap between the national number and the Florida number, so even if our growth rate is moderately higher that the nation as a whole (and growth is good), in terms of actual dollars, it is not clear we really shrinking the gap.

And then there is this:

Redfin said the 5.3% national uptick marked the largest gain in nearly a year.

It is only a snapshot, but not keeping up with the national average growth is kind of odd for a boomtown with a housing crisis, unless people are just tapped out and cannot afford anymore. On the other hand

There is money somewhere. It will be interesting to see where this goes.

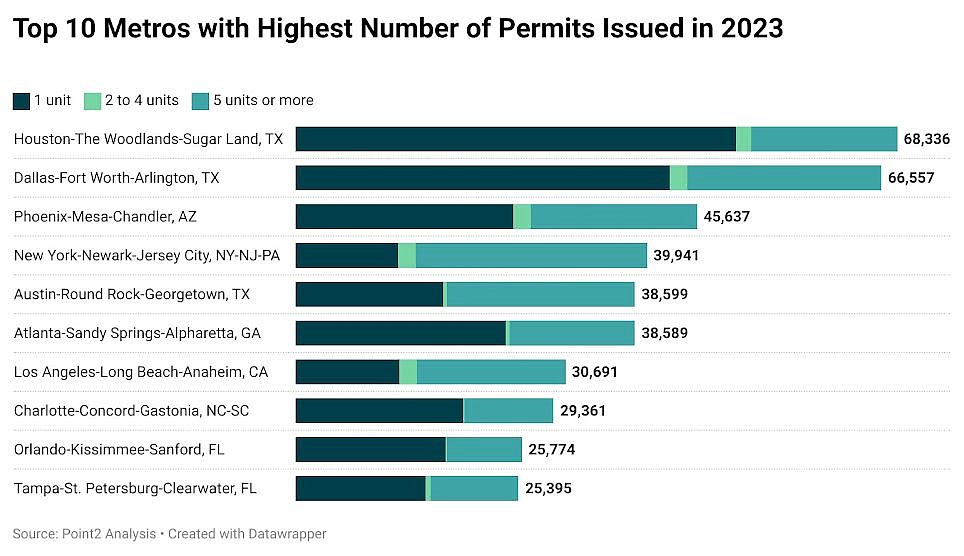

Meanwhile,

Being on the list of the most permits but having the number of permits actually drop is a mixed message. Given the overall situation in the local housing market, though, it will not get fixed with decreasing construction over time.

You can read the report here.

Most decent sized projects involve architects in some way. Therefore, they have a decent idea about development trends.

All that is reasonable.

That sounds contradictory, but we suppose “strong” is a relative term. We will see.

In related news, the Census came out with new population growth numbers. Among the interesting items:

Top 10 U.S. Metro Areas in Annual Numeric Growth:

|

|||||

| Rank | Metro Area | April 1, 2020 (Estimates Base) |

July 1, 2022 | July 1, 2023 | Numeric Growth |

| 1 | Dallas-Fort Worth-Arlington, TX | 7,637,398 | 7,947,439 | 8,100,037 | 152,598 |

| 2 | Houston-Pasadena-The Woodlands, TX | 7,149,604 | 7,370,464 | 7,510,253 | 139,789 |

| 3 | Atlanta-Sandy Springs-Roswell, GA | 6,106,847 | 6,238,676 | 6,307,261 | 68,585 |

| 4 | Orlando-Kissimmee-Sanford, FL | 2,673,391 | 2,763,017 | 2,817,933 | 54,916 |

| 5 | Tampa-St. Petersburg-Clearwater, FL | 3,175,291 | 3,291,341 | 3,342,963 | 51,622 |

| 6 | Charlotte-Concord-Gastonia, NC-SC | 2,660,348 | 2,754,657 | 2,805,115 | 50,458 |

| 7 | Austin-Round Rock-San Marcos, TX | 2,283,379 | 2,423,170 | 2,473,275 | 50,105 |

| 8 | Phoenix-Mesa-Chandler, AZ | 4,851,102 | 5,020,870 | 5,070,110 | 49,240 |

| 9 | San Antonio-New Braunfels, TX | 2,558,115 | 2,655,928 | 2,703,999 | 48,071 |

| 10 | Miami-Fort Lauderdale-West Palm Beach, FL | 6,138,356 | 6,139,812 | 6,183,199 | 43,387 |

We are going to have to put those people somewhere and be able to move them around (and there is only so much room for widening roads).

Governance/Politics — Elections

Meanwhile, the County Commission is doing Hillsborough County Commission things (actually this is odd even for the County Commission):

Given what has gone before, that is not really surprising. Interestingly:

We did not know the Commissioners were so soft on election security.

And we are not really sure the point of this move. In recent history, Hillsborough’s elections have historically been pretty well run (unlike some parts of Florida). And they do not seem to be controversial. Consequently, we are surprised the Commission majority is cutting money to the Election Supervisor’s office in a Presidential election year with all the rules, challenges, and changes to the voter rolls. We like the lack of voting drama in our county, and we would prefer to maintain a well-funded election office that communicated properly with the public to make sure our election stay smoothly run and secure.

The Airport got a few more accolades recently. First,

You can see more results here

Then, Time Out ranked its Wi-Fi third best in the US (you decide for yourself about public Wi-Fi security in general).

Roundup 3-8-2024

Contents

— A Little Civics Lesson Every Now and Then is a Good Thing

West Tampa/Downtown/Hyde Park – On the Waterfront

Meanwhile, In the Rest of the State

__________________

For a while now, there have been ideas floated to change the Selmon exit at Florida downtown (like the earlier one here). Now, there is a new idea:

- The eastern extension of Whiting Street from the expressway toward Meridian Avenue will connect the Channel district and the central business district. THEA board members voted on Feb. 26 to change the design of the new Whiting Street section to include a bidirectional bike lane.

- A new exit ramp from the Lee Roy Selmon Expressway into the Channel district will now come to a controlled stop perpendicular to Whiting Street rather than allowing free right turns.

- Exit 6B — which is closed during downtown events — will be removed, eliminating the five-way intersection near Amalie Arena.

- Exit 6A at Florida Avenue will be reconfigured. Landscaping along the inside of the loop ramp will be removed and a new barrier protection for motorists installed. The tight curve, however, will remain.

“[This] is a much better alternative than what it was,” THEA CEO Greg Slater said of the changes.

We do not see how cutting Nebraska off from Whiting helps reconnect the grid at Whiting. It may help connect another road (though that is not completely clear) but it is cutting others. And we do not see how removing a ramp that lands right at the arena’s front door helps access to the arena. (To us, the cars looping onto Florida are far scarier as a pedestrian than the ramp that came down near the arena, and people flying off the highway into a curved, downward sloping exit at Whiting is not going to be particularly pedestrian friendly). If anything, this new plan is a wash – except for the cost and the fact that a big ramp wall is not very attractive and it appears it longer and harder to walk under or around than what is there now.

The previous plan linked above with the pedestrian tunnel under the ramp and green space seemed to make a lot more sense to us (though maybe not three lanes at the end of the ramp).

We appreciate the City trying to work on the themes discussed, but a little more thought on this one seems in order.

There was interesting news about Amtrak service (or lack thereof):

Why? It is not clear. It could be an oversight by the planners. It could be laziness or complacency by local officials in not advocating for inclusion. It could be both. It could be something else. Regardless,

Looking at the map it looks like the path even swerves towards Tampa but then turns away.

The whole thing is quite odd in theory, but not unusual for this area. We often seem to get overlooked or underserved, and local officials often let it slide. We should stop letting it slide. There is no good reason to not have us on the line and more integrated into the infrastructure of the state and country (especially if we are the breakout boomtown local officials seem to always be talking about). And if the Federal government is going to invest in transportation, including rail, we should get our share.

And

Even in an initial concept, ignoring a major metro area like that makes no sense. (What is the point of reviving rail service if it arbitrarily ignores large chunks of population?)

We are glad that the Friends of Union Station brought it to everyone’s attention, but local officials and our Congressional delegation should have been on it already and should address it now.

The report is here (maps of Chicago-Miami route on pg. 63 and Dallas-Miami route on pg. 64) and general study website here.

You can send the study comments here.

One of the common complaints about transit projects is that they come in late and over budget (and, sadly, that is often true for a variety of reasons). But it is not unique to transit.

It is certainly late. We did not see information about whether it is over budget.

As we have said previously, we think the Gateway Express project, for the most part, is a good project (and we are fine with the fixed tolls plan). It is now years late, but it is still a good idea and no one will notice the lateness in a few years.

However, it would be better if they could build things on time and on budget. And it would be nice if people acknowledged the truth that road projects have many of the same problems as transit.

For decades, one of the few alternatives to Dale Mabry in northern Tampa has been Himes. Himes actually goes from Palma Ceia all the way to Busch making it very useful. It has well-spaced-lights. The speed limit is not that fast but as an alternative route it is good.

Now, for whatever reason (probably the same ridiculous planning that pushes all traffic onto a small number of overburdened arterial roads), it seems the county has decided to start screwing it up. Last week we were driving on Himes for the first time in a while and discovered that someone had put a 4-way stop at Himes and Idlewild (turns out this intersection is in the County just outside the Tampa City limits), not very far north of the light at Hillsborough from which many St. Lawrence and Jesuit families as well as others drive (that’s probably quite fun with a random 4-way stop). It was not there when this was taken. Moreover, Idlewild has speed humps to stop people cutting through from Dale Mabry and Habana. In other words, someone decided to completely disrupt the flow of the road and counterintuitively make every car stop for at a not busy intersection that the County already tried to make less busy which is also right near a light. (It apparently did not occur to the traffic people in charge that their traffic interventions contradicted each other).

We understand slowing traffic and pedestrians safety. Neither of those issues really applies to this particular intersection. Frankly, as far as we can tell, it is likely either a poor decision to apply some traffic engineering theory inappropriately or caving to the loud complaints of a small group of residents, resulting in messing up one of the few alternatives to an overburdened and almost universally-accepted-as-horrible Dale Mabry. (Why the County would work hard to encourage more people to drive on Dale Mabry is beyond us)

Hopefully, it is some strange traffic experiment the news of which we missed and it will be removed forthwith.

Frankly, a light would have been much better. At least, it would not disrupt any possible traffic flow by forcing every car to stop for no reason.

We could say much more, but we’ll just say it should be removed and the decision-making process should be reviewed.

— A Little Civics Lesson Every Now and Then is a Good Thing

Over time there has been a lot of debate about proposals to provide better civics education in Florida. We are not going to get deeply into that, but this week a Times article made us serious consider the merits of the idea. The article in question was discussing an attempt to ban the Hillsborough indigent care tax. (We are not going to discuss that issue, either). Here is the relevant part:

We do not know if the quote is accurate, but, if it is, we hope someone took this Commissioner aside and told him, “Excuse me Commissioner, but you are the representation.” But, in case that did not happen, we decided to do our own brief explanation.

In very simple terms, there is direct democracy and representative democracy/representative government. Direct democracy is where voters directly vote on things and, as it indicates in the name, directly say what they want. Because the voters have their own voice, it does not involve representation at all. Setting aside all the legal processes and necessary approvals to get something on the ballot, a referendum is an example of direct democracy.

In simple terms, representative democracy involves voters choosing people to represent them. Those people then vote on behalf of the people they represent. (We will save all the debate about Burke’s ideas of what a proper representative does for another time.) A nice example (especially since the name is so clear), the House of Representatives has people elected to represent the interests of the voters, hence the name Representatives.

Here is a snappy British video about the difference between direct and representative democracy (and as anyone who watches cable news or any movie about ancient times knows, if the speaker has some British-ish accent, many think they have more gravitas and because we do not think there is Schoolhouse Rock video exactly on point):

The slogan “no taxation without representation” arose because, before the American Revolution, the British Parliament was imposing taxes on the 13 colonies but the colonies did not have elected representatives in said British Parliament. Thus, they had no representation in the votes imposing those taxes. It had nothing to do with the voters directly voting on each tax measure.

Fast forward to today, and we have a mostly representative government, including at the county level. In Hillsborough County, the elected representatives (and, admittedly, for many Commissioners, the term “representative” can in many ways be used rather loosely, but, for the purposes of this discussion, it remains accurate) are the County Commissioners. Having them vote on an issue (like the indigent tax, or fees or a zoning issue) is representation. One may not like what they do, but that is still representation in the sense used in the slogan “no taxation without representation”. And if you do not like what they do, you can vote them out of office (at least in theory).

Now, if someone thinks every tax should be by referendum (how about all fees?), that is their choice, but it has nothing to do with the slogan or representation.

Speaking of taxes and referendums, it seems there is a new plan being formulated for the Referendum money: